The smart Trick of Transaction Advisory Services That Nobody is Discussing

Table of ContentsExcitement About Transaction Advisory ServicesThe Transaction Advisory Services StatementsTransaction Advisory Services Things To Know Before You Buy7 Simple Techniques For Transaction Advisory ServicesNot known Facts About Transaction Advisory Services

This action makes sure the company looks its finest to prospective buyers. Getting the company's value right is crucial for an effective sale.Purchase consultants action in to aid by getting all the needed information organized, responding to concerns from customers, and organizing check outs to the service's area. This builds trust with customers and maintains the sale relocating along. Getting the very best terms is vital. Purchase experts use their know-how to aid company owner take care of tough negotiations, meet customer assumptions, and structure deals that match the proprietor's objectives.

Satisfying legal rules is essential in any kind of company sale. They help organization owners in intending for their following steps, whether it's retirement, beginning a new endeavor, or handling their newfound wide range.

Deal experts bring a wealth of experience and understanding, ensuring that every facet of the sale is dealt with properly. Through calculated prep work, valuation, and settlement, TAS assists entrepreneur accomplish the greatest feasible sale price. By guaranteeing legal and regulative conformity and managing due persistance alongside other offer group participants, transaction advisors decrease potential risks and obligations.

Some Known Questions About Transaction Advisory Services.

By comparison, Large 4 TS groups: Work with (e.g., when a possible purchaser is performing due persistance, or when a bargain is shutting and the purchaser needs to incorporate the business and re-value the seller's Balance Sheet). Are with charges that are not linked to the offer shutting successfully. Gain costs per engagement somewhere in the, which is much less than what financial investment financial institutions earn even on "small deals" (yet the collection chance is likewise a lot higher).

, however they'll focus extra on accountancy and appraisal and less on subjects like LBO modeling., and "accountant just" subjects like trial equilibriums and how to stroll through occasions utilizing debits and credit histories rather than economic statement adjustments.

Top Guidelines Of Transaction Advisory Services

that demonstrate exactly how both metrics have transformed based upon products, channels, and consumers. to evaluate the accuracy of administration's previous forecasts., including aging, stock by product, ordinary levels, and arrangements. to establish whether they're completely fictional or rather credible. Professionals in the TS/ FDD groups may also speak with administration about whatever over, and they'll create a detailed report with their searchings for at the end of the procedure.

, and the general form looks like this: The entry-level duty, where you do a whole lot of information and economic evaluation (2 years for a promotion from here). The next degree up; comparable job, however you get the even more fascinating bits (3 years for a promotion).

Particularly, it's hard to obtain promoted past the Supervisor level because couple of people leave the job at that phase, and you require to start showing proof of your ability to generate earnings to advance. Allow's start with the hours and lifestyle considering that those are simpler to describe:. There are periodic late nights and weekend break work, but absolutely nothing like the frenzied nature of financial investment banking.

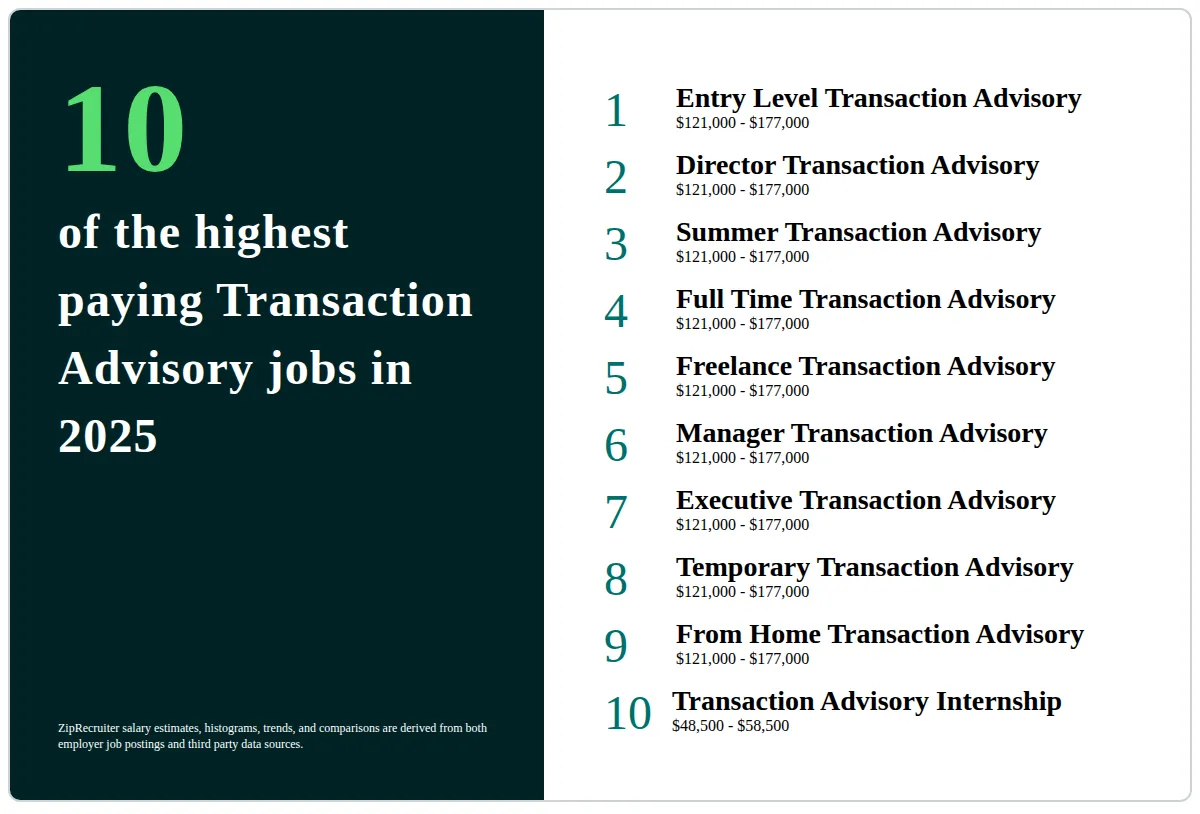

There are cost-of-living changes, so expect lower payment if you're in a less expensive area the original source outside significant monetary (Transaction Advisory Services). For all placements except Partner, the base wage Homepage comprises the mass of the total compensation; the year-end reward could be a max of 30% of your base salary. Typically, the most effective method to raise your earnings is to change to a different company and negotiate for a higher wage and incentive

Transaction Advisory Services Can Be Fun For Anyone

You could get into corporate advancement, yet investment financial gets much more difficult at this stage since you'll be over-qualified for Analyst roles. Corporate money is still an option. At this stage, you should just remain and make a run for a Partner-level duty. If you intend to leave, perhaps relocate to a client and perform their assessments and due persistance in-house.

The main problem is that because: You usually require to sign up with one more Big 4 team, such as audit, and job there for a couple of years and afterwards move right into TS, work there for a few years and afterwards relocate into IB. And there's still no guarantee of winning this IB duty since it relies on your area, clients, and the working with market at the time.

Longer-term, there is likewise some risk of and due to the fact that reviewing a firm's historic financial details is not precisely brain surgery. Yes, human beings will certainly always require to be involved, yet with advanced innovation, reduced headcounts can potentially sustain client engagements. That stated, the Transaction Providers group defeats audit in terms of pay, work, and leave possibilities.

If you liked this short article, you may be curious about reading.

The Transaction Advisory Services Diaries

Develop advanced monetary frameworks that help in establishing the real market price of a firm. Provide advisory job in relationship to business evaluation to aid in negotiating and prices structures. Clarify the most suitable kind of the offer and the type of consideration to use (cash money, supply, earn out, and others).

Develop activity strategies for risk and direct exposure that have actually been determined. Perform integration planning to determine the procedure, system, and business modifications that may be needed after the offer. Make numerical price quotes of combination Home Page costs and advantages to analyze the financial rationale of assimilation. Set standards for integrating departments, innovations, and business procedures.

Assess the possible consumer base, industry verticals, and sales cycle. The operational due persistance offers important understandings right into the performance of the firm to be obtained concerning threat assessment and value production.